IRS extends deadlines for all North Carolina taxpayers to September

The agency says individuals and households that reside or have a business anywhere in North Carolina qualify for tax relief.

WASHINGTON, D.C., USA — The Internal Revenue Service (IRS) has once again extended several deadlines for North Carolina taxpayers because of the “lingering effects of Hurricane Helene.

The IRS announced Thursday that the deadline has been extended from May 1 to September 25. According to a press release, “individuals and households that reside or have a business anywhere in North Carolina qualify for tax relief.”

The IRS said the September 25 deadline will now apply to:

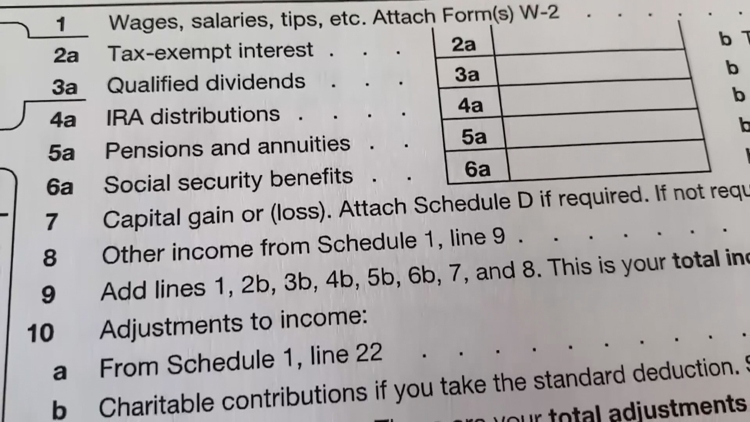

- Individual income tax returns and payments normally due on April 15, 2025.

- 2024 contributions to IRAs and health savings accounts for eligible taxpayers.

- 2024 quarterly estimated tax payments normally due on Jan. 15, 2025, and 2025 estimated tax payments normally due on April 15, June 16 and Sept. 15, 2025.

- Quarterly payroll and excise tax returns normally due on Oct. 31, 2024, and Jan. 31, April 30 and July 31, 2025.

- Calendar-year corporation and fiduciary returns and payments normally due on April 15, 2025.

- Calendar-year tax-exempt organization returns normally due on May 15, 2025.

- 990, 1040, 1041 and 1120 filers with a valid extension for tax year 2023. Please note, the payments on these returns are not eligible because they were due last spring before the hurricane.

According to the press release, individuals looking for details on other returns, payments and tax-related actions qualifying for relief during the postponement period can visit the disaster assistance and emergency relief for individuals and businesses page.

The IRS says anyone who needs a tax filing extension beyond the September 25 deadline can get one, but they must request extra time.